Which of the Following Is an Example of Revenue

ACash received from a bank loanBCash received from investors from the sale of common stock C. Rent earned during the period to be received at the begining of the next year Which of the.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

A Prepaying insurance coverage for the next 12 months B Delaying the payment of interest on an outstanding loan until next year C Receiving cash in advance of a service to be provided to a customer D Providing services to a customer without having yet collected the cash.

. List examples of temporary differences that create. Cash received from a client before the service is provided. Repair and Maintenance of the Assets The expenditure incurred on the repairs and maintenance of the assets generating the revenues Revenues Revenue is the amount of money that a business can earn in its normal course of business by selling its goods and services.

Which of the following is an example of revenue management with booking limits. In other words the sales generated by a business. However it charges for additional users and services.

Which of the following is an example of accrued revenue. D Cash collected from an account receivable. Cash received from customers at the time services were provided DCash received from the sale of land for its original selling price Answer.

Operating Revenue Revenue that results from the normal business activities. Accounting questions and answers. Using the cash basis of accounting the revenue is reported in November 2010.

Cash collected from an account receivable. C Wages owed to employees who worked during the period. Repairs on purchase of second asset to put it in to working condition is a capital expenditure.

Net Revenue Revenue after expenses. A Cash received from a client before the service is provided. Which of the following is an example of accrued revenue.

Product Revenue Sales of tangible items such as a toothbrush. 39which of the following is an example of revenueAcash received as a result of a bank loanBcash received from investors from the sale of common stockCcash received from Customers at the time services were providedDcash received from the sale of land for its original selling price 40. In federal state and local government revenue refers to the money an entity receives from finespenalties property and sales taxes income taxes corporate payroll contributions rental fees intergovernmental transfers and securities sales.

This can be negative. An agreement that has been signed for snow removal services for the next three months d. An agency responsible for collecting taxes.

Which of the following is not a revenue that is shared under league revenue-sharing systems. Correct option is D Revenue expenditure are those which are incurred during the normal course of business. Cash collected for goods we shipped to a customer two months ago.

Using the accrual basis of accounting the revenue is reported when Aslers expenses are paid. Using the accrual basis of accounting the revenue is reported in November 2010. Using the accrual basis of accounting the revenue is reported in January 2011 B.

Which of the following is an example of revenue or expense to be recognized in the current periods income statement. Which of the following is an example of a gov. Interest on debt incurred during the year to be paid in the first quarter of the subsequent year b.

C A hotel cuts its full fare to ensure that more rooms are filled. A A seller of bandwidth offers a low fare for regular speed service and a high fare for high speed service. Which of the following is an example of revenue or expense recognized in the current periods income statement.

Cash received from a client before the lawyer represents them in court. A deferred tax asset is a balance sheet item that results from an excess or early tax payment. ACash received from a client before the service is provided.

The average number of days inventory is held should be minimized for ALL of the following reasons EXCEPT _____. DCash collected from an account receivable. Which of the following is an example of an accrued revenue.

Rent paid at the beginning of the year and debited to an expense account. Best describes the growth of the federal service in the past 35 yrs. Gross Revenue Revenue before expenses.

Below are the example of capital expenditure. Snow removal services that have been provided but have not been billed or paid c. Snow removal services that have been paid for three months in advance b.

Utility and usage revenue model b. 14 Which of the following is an example of revenue or expense to be recognized in the current periods income statement. Revenue expenditure are debited to profit loss account.

In the case of the federal government it refers to the total amount of income generated from taxes which. The revenue recognition principle dictates that revenue be recognized in the accounting period For a pure monopolist the relationship between total revenue and marginal revenue is such that. Wage costs owed to employees who worked during the period.

Freemium revenue model d. Inventory purchased for sale to customers. A Snow removal services that have been paid for three months in advance B Snow removal services that have been provided but have not been billed or paid C An agreement that has been signed for snow removal services for the next three months.

Which of the following is an example of revenue or expense to be recognized in the current periods income statement. Wages owed to employees who worked during the period. Stable relationship bw a bureaucratic agency a clientele group and a legislative committee is called.

Snow removal services that have been provided and paid on the same day. B A hotel cuts its discount fare to ensure that more rooms are filled. The following are common types of revenue.

Examples of revenue The following are some examples of revenue across various sectors. BInventory purchased for sale to customers. Professional revenue model c.

Cost of issuing shares and debentures is a capital expenditure. Which of the following items is an example of revenue. This is an example of which of the following revenue models.

The video Revenue Metrics. Inventory purchased by a retail store. Which of the following is an example of an accrued revenue.

CCost of utilities used during the period. B Inventory purchased for sale to customers.

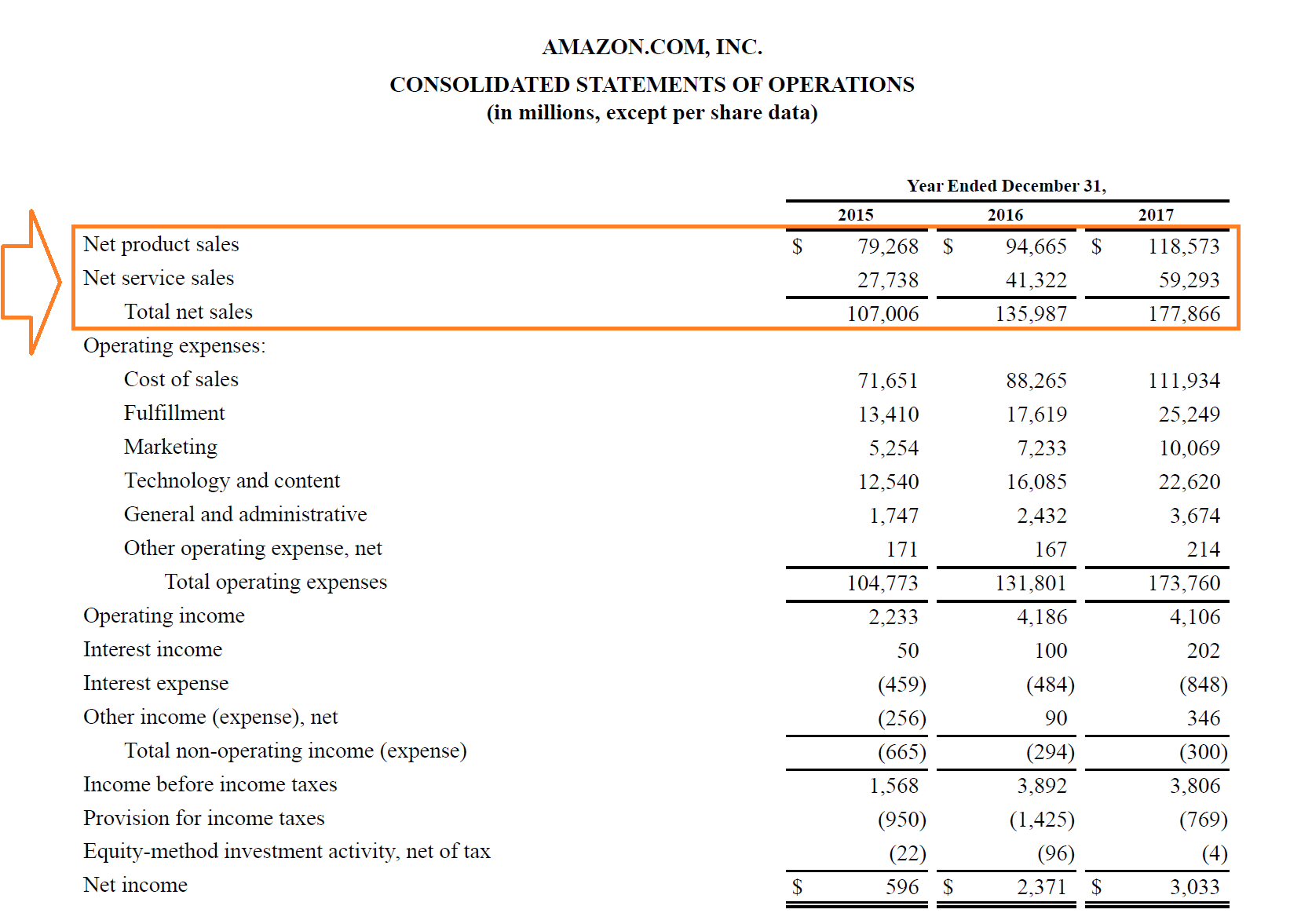

Revenue Definition Formula Example Role In Financial Statements

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

Revenue Definition Formula Example Role In Financial Statements

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-02-0538cfc8437b4b2ba4724c9443c6d393.jpg)

0 Response to "Which of the Following Is an Example of Revenue"

Post a Comment