A FIRM CHARGES A MAXIMUM PRICE WITHOUT ATTRACTING NEW ENTRANTS

Ate a barrier for new entrants. Price discrimination occurs when a firm charges different prices.

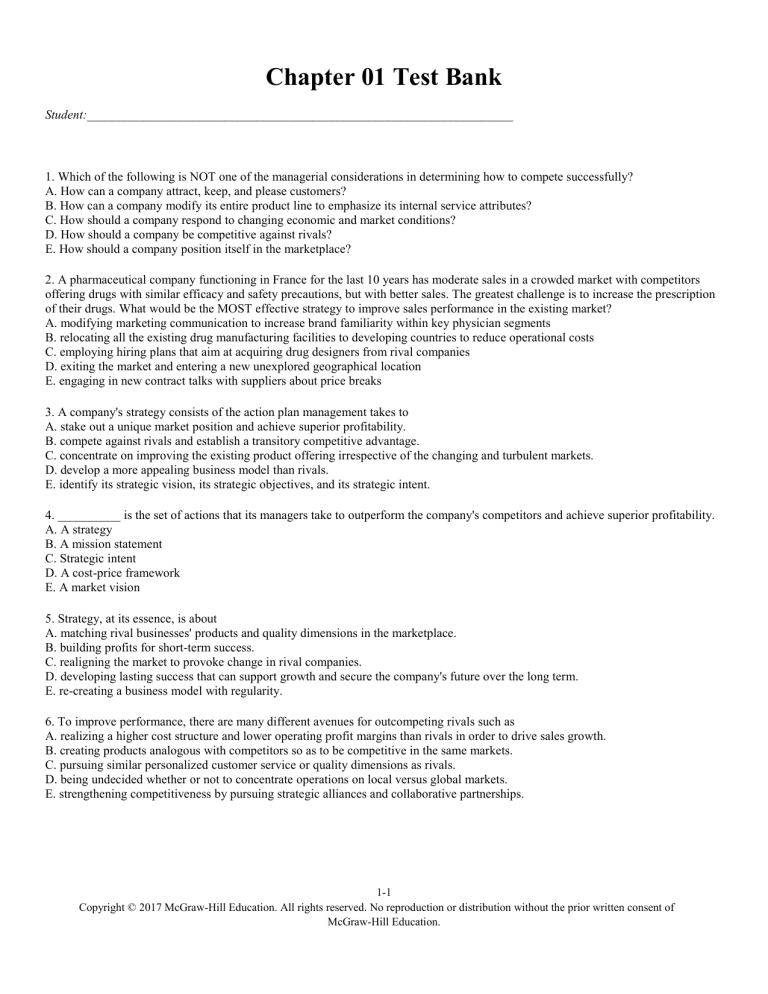

Pricing Decisions Mcq Free Pdf Objective Question Answer For Pricing Decisions Quiz Download Now

When existing firms set a low price and a high output so that potential entrants cannot make a profit at that price.

. This is the maximum price GM can set without attracting new entrants. Above a competitive level without attracting new firms to enter the industry Bain 1965 p. - on one day the firm charges a low price and on another day it will charge a high price -By increasing the uncertainty firms reduce consumers incentive to shop for price information -To continually find the best deal the consumer would have have to constantly shop for a new deal 2.

The distance P L P C is referred to as the entry premium the degree to which price can exceed the competitive price without allowing entry. A blue ocean strategy typically allows a firm to - provide unique product or service features at a premium price. A a contestable market B a monopolistically competitive market C a monopsonistic market D a perfectly competitive market.

The theory of Bains limit pricing has been further developed by Sylos-Labini Modigliani and Jagdish Bhagwati. As if state regulators did not have enough to grapple with in restructuring along comes another critical issue. This will increase their customer base as more people will be willing to buy US cars due to the low price.

However after a maximum price P1 is imposed A shortage of Q1 Q2 arises. The higher the amount spent by incumbent firms the greater the deterrent to new entrants. Subsequently other authors have come up with their own definitions.

Occurs when a firm charges each consumer the maximum price he or she would be willing to pay for each unit of the good purchased. The essence of the job of the strategist is to cope with competition. Like Bains definition most of them focused on the asymmetry in the costs of production between incumbent firms and entrants see Stigler and Baumol Willig in.

- reduce the value gap created by their products. With a post-entry price just below P C they make a loss. A strong brand value creates loyalty of customers and hence discourages new firms.

Impeded entry which allows established sellers to raise their selling prices above minimal average costs but not as high as a monopolists price without attracting new sellers. A a contestable market. For the exclusive use of G.

What is the firms objective if it produces output OX. In the analysis we would deal with first four barriers only. Incumbent firms price at a lower level than would create maximum profits in the short-run in order to deter new entrants they are attracted to supernormal profits 10 of 64 Why would a firm in a contestable market build artificial barriers to entry.

The limit price is the highest price that can be charged without inducing new entry fOligopoly firms do not charge monopoly price because it attracts newer firms to the industry this. Blockaded entry which allows established sellers to set monopolistic prices if they wish without attracting entry. While pricing set above the incumbent average cost and at the same time below monopoly price this show Michelin takes into consideration the long-term profitability and deterrence of entrants by giving up some profits in the short-run.

However if efficiencies differ among established firms the limit price will be set by the most efficient least-cost firm. Name Entered on Points Result. Earn monopoly prices14 without attracting new entry.

As a practical matter the antitrust authorities have used a 5 sometimes 10 percent price increase that persists for two years without attracting substantial new entry into the market so defined as a benchmark for drawing the boundaries of. Maximum competition scholars judges and enforcement agencies have arrived a. As the potential firm believes that existing firms will maintain output they know that P L is an entry preventing price.

Reduce the ability of rival firms to undercut the firms price. GM will lower their prices against rivals as well as new entrants. Product-differentiation Barriers The preference of buyers attached to various existing brands creates barriers to the entry of a new firm.

In the analysis we would deal with first four barriers only. Without attracting new rms to enter the. Maximum value average and standard deviation.

First-degree price discrimination A. Occurs when a firm charges each consumer the maximum price he or she would be willing to pay for each unit of the. In which type of market does this firm operate.

A to achieve normal profit B to maximise profit C to maximise total revenue D to minimise average cost 11 A firm charges the maximum price it is able to charge without attracting competition from new entrants. For assessing whether firms can come into the market and constrain price increases by incumbent firms11 When measuring market power barriers to entry may allow for. These are sunk costs.

Maximum of 43 points. The arena in which competition takes place is the industry in which a company and its rivals vie for business. These are exogenous and if they exist firms can charge any price without the fear of attracting new entrants.

These are exogenous and if they exist firms can charge any price without the fear of attracting new entrants. The threat of potential entry defined by the strength of barriers to entry is crucial in pricing decisions. In which type of market does this firm operate.

Results in the firm extracting all surplus from consumers. Unfortunately how to detect if and when there is a market power problem will require continuous monitoring and determining what actions should be taken to avoid or correct a problem are not easy. One may distinguish three rough degrees of difficulty in entering an industry.

Price strategies such as limit pricing will help to reduce GMs losses. Thus a probability that Michelin attempts to charge the highest price possible without attracting new firms into the market is logical. 1-50 QUESTIONS right or false will be displayed at the end of the quiz.

- add product features that raise costs without raising the perceived value. There is a recognized double interdependence between existing firms and between them and potential entrants. The preference of buyers attached to various.

Charge the price that is equal to the short run profit maximizing price but charges a lower price so as to prevent the entry of new firms in the industry. Entrants Hence firms will behave as if under strong competition and be unable to set prices above AC without attracting new entrants thus earning only normal profits in the long run. 11 A firm charges the maximum price it is able to charge without attracting competition from new entrants.

The theory of limit pricing is also known as entry preventing pricing.

Risks Free Full Text Fintech In Latvia Status Quo Current Developments And Challenges Ahead Html

Tips For Delivering The Best Service To Your Customers Powerpoint Presentation Slides Presentation Graphics Presentation Powerpoint Example Slide Templates

Contestable Markets A2 Economics Ppt Video Online Download

Pdf Barriers Hindering The Entry Of New Firms To The Competitive Market And Profitability Of Incumbents

Pricing Decisions Mcq Free Pdf Objective Question Answer For Pricing Decisions Quiz Download Now

0 Response to "A FIRM CHARGES A MAXIMUM PRICE WITHOUT ATTRACTING NEW ENTRANTS"

Post a Comment